kobag.ru

News

Auto Insurance For Seniors Over 65

Drivers over 65, along with new teenage Binder - A short-term agreement that provides temporary auto coverage until your auto insurance policy starts. For example, the law prohibits refusal of insurance solely on the basis of the applicant's age (age 65 or older), credit information, or status as a volunteer. The best auto insurance company for seniors is Geico because it has the cheapest premiums for senior drivers, according to WalletHub's analysis. Geico also. To take advantage of the available auto insurance discount, you must be 55 years of age or older and complete an approved mature driver improvement course. Senior Drivers. License Renewal. Customers age 64 and older are required to take a vision screening at each renewal period. Customers can renew in. Cost of Life Insurance for Seniors Over 60 ; Age, Whole: $10, - $1,, Benefit, Term: $, - $1,, ; 60, $ - $35,, $ - $4, ; 65, $ If you are a senior or over 50, you could qualify for auto insurance discounts. Discounts are available for defensive driving course completion, multiple car. The average senior driver in the U.S. pays $1, annually or $ monthly for auto insurance. Saving money at any age is important, but drivers aged 55+ can. The average senior driver in the U.S. pays $1, annually or $ monthly for auto insurance. Saving money at any age is important, but drivers aged 55+ can. Drivers over 65, along with new teenage Binder - A short-term agreement that provides temporary auto coverage until your auto insurance policy starts. For example, the law prohibits refusal of insurance solely on the basis of the applicant's age (age 65 or older), credit information, or status as a volunteer. The best auto insurance company for seniors is Geico because it has the cheapest premiums for senior drivers, according to WalletHub's analysis. Geico also. To take advantage of the available auto insurance discount, you must be 55 years of age or older and complete an approved mature driver improvement course. Senior Drivers. License Renewal. Customers age 64 and older are required to take a vision screening at each renewal period. Customers can renew in. Cost of Life Insurance for Seniors Over 60 ; Age, Whole: $10, - $1,, Benefit, Term: $, - $1,, ; 60, $ - $35,, $ - $4, ; 65, $ If you are a senior or over 50, you could qualify for auto insurance discounts. Discounts are available for defensive driving course completion, multiple car. The average senior driver in the U.S. pays $1, annually or $ monthly for auto insurance. Saving money at any age is important, but drivers aged 55+ can. The average senior driver in the U.S. pays $1, annually or $ monthly for auto insurance. Saving money at any age is important, but drivers aged 55+ can.

As you age, providing security for your loved ones can become a more pressing sentiment. Whole life insurance is another great option for seniors that will. There are no specific senior car insurance plans. Instead, senior drivers must purchase the same set of basic requirements as those for drivers of all ages. For example, teenagers and seniors have more acci- dents. Because they Licensed auto insurance agents must offer cov- erage through the Plan for. Getting the right coverage is important — a robust policy can save you hundreds of thousands of dollars after an accident. But getting that coverage at a rate. Drivers over 65, along with new teenage drivers, have more accidents for Insurance program which helps good drivers that are income eligible affordable auto. As people age, auto insurance rates generally decrease. However, around age 65, car insurance costs for senior drivers often begin to rise again. 9. Lapse. However, unlike your standard travel insurance, senior travel insurance caters to travellers over the age of 65, who are more vulnerable to illnesses, diseases. For seniors with a ticket, State Farm is the cheapest option for car insurance. This company offers affordable rates after getting a ticket on your record and. Your travel insurance rates will increase every five years at 60, 65, 70 – you get the picture. As you age, the risks increase, so your travel insurance. However, while seniors may see their insurance premiums increase, they likely will not go back to paying the high rates of teen drivers, assuming their driving. For seniors with a ticket, State Farm is the cheapest option for car insurance. This company offers affordable rates after getting a ticket on your record and. Drivers over 65, along with new teenage drivers, have more accidents for Insurance program which helps good drivers that are income eligible affordable auto. The Insured Declared Value (IDV) offered by an insurance company for an old or aged car is lower than that of a new car. Age of a car affects. How your age affects auto insurance If you are in your 60s: You may still have a lower senior car insurance premium if you have a clean driving record and no. That's why belairdirect created insurance products specifically for experienced drivers who are 50 years and older. It's the perfect way for senior citizens and. Up to 6 months after your 60th birthday, you can choose the Year Term plan, where the premium remains unchanged for each term. While the coverage ends once. How to Get the Best Car Insurance for Seniors · AAA · Allstate · Esurance · GEICO · Mercury · Progressive · State Farm · The Hartford. Its Whole Life policy is available to applicants up to age With whole life polices with coverage levels starting at $25,, seniors can find a policy. Age is one of the most important factors in determining your car insurance rate. This may seem unfair because there are good drivers in every age group. Home insurance for seniors is not much different than policies for other age groups. Bundling home and auto insurance. Most insurance companies offer.

Best Forums For Stock Trading

General Forums · Stock Market Today · Stock Message Boards NYSE, NASDAQ, AMEX · Penny Stocks · Canadian Stocks Message Boards · International Stock Markets · Trade. SteadyOptions is the most active options trading forum on the Internet. You can be part of the solution and find solutions from top options traders. r/stocks: Welcome on /r/stocks! Don't hesitate to tell us about a ticker we should know about, market news or financial education. But please, read. Bullboards ; kobag.ru Post by Yajne 1 hour ago. Great NR's - next few mo's? Whether it's this week of next week, I hope PYR and HPQ bombard us with NR's from now. Forums / Latest Liked · All Forums · Interactive Trading · Trading Systems · Trading Discussion · Platform Tech · Broker Discussion · Trading Journals · Rookie Talk. You will get absolutely annihilated as a newbie intraday trader in these market conditions. Best throw your money at a global tracker in a stocks and shares ISA. Join Stockopedia's investor discussion forums for over shares across the globe, including investing articles and interviews. Join today! Traderji Stock Market Discussion Forum. Traderji stands out as the most popular forum for Traders in India with over over 2+lakhs members participating in. Message boards that are categorized as Stock Market - Investing Groups, NASDAQ, AMEX, NYSE, OTC Markets. General Forums · Stock Market Today · Stock Message Boards NYSE, NASDAQ, AMEX · Penny Stocks · Canadian Stocks Message Boards · International Stock Markets · Trade. SteadyOptions is the most active options trading forum on the Internet. You can be part of the solution and find solutions from top options traders. r/stocks: Welcome on /r/stocks! Don't hesitate to tell us about a ticker we should know about, market news or financial education. But please, read. Bullboards ; kobag.ru Post by Yajne 1 hour ago. Great NR's - next few mo's? Whether it's this week of next week, I hope PYR and HPQ bombard us with NR's from now. Forums / Latest Liked · All Forums · Interactive Trading · Trading Systems · Trading Discussion · Platform Tech · Broker Discussion · Trading Journals · Rookie Talk. You will get absolutely annihilated as a newbie intraday trader in these market conditions. Best throw your money at a global tracker in a stocks and shares ISA. Join Stockopedia's investor discussion forums for over shares across the globe, including investing articles and interviews. Join today! Traderji Stock Market Discussion Forum. Traderji stands out as the most popular forum for Traders in India with over over 2+lakhs members participating in. Message boards that are categorized as Stock Market - Investing Groups, NASDAQ, AMEX, NYSE, OTC Markets.

Stocktwits provides real-time stock, crypto & international market data to keep you up-to-date. Find top news headlines, discover your next trade idea. One of the smaller options for Canadian stock forums, Stockaholics' members discuss everything from penny stocks to trade journals and even crypto trading. If. Investing - stocks, bonds, mutual funds, trading, market, brokers. In The Best Traders Trading Community, We Are Dedicated To Delivering An Exceptional Trading Experience. By Joining This Esteemed Trading Forum, You Gain Access. Find the latest BEST Inc. (BEST) stock discussion in Yahoo Finance's forum. Share your opinion and gain insight from other stock traders and investors. For appeals, questions and feedback about Oracle Forums, please email [email protected] What's the best way for the trading applications. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial. Here are some of the best day trading forums: · Bear Bull Traders · Elite Trader · MyPivots · kobag.ru ValueForum - online discussion community for stock & bond market investing forums, trading tips, research & income investments - trade ideas, strategies. Elite Trader is the #1 site for traders of stocks, options, currencies, index futures, and cryptocurrencies. Top ranked stock market message boards, educational tools and trading resources. The main function is to provide a forum where readers and users can share their thoughts. Finance message boards are often flush with hot stock ideas and. Direct access to ONeil Trader; Real-time community chat; Model portfolio; Coverage universe; Trading Ideas; Frequent updates and coverage. Q&A about indicators Day Trading Strategies, Stocks in play. I pretend to show you what I consider the best way to trade if you have a small account. Welcome to the Citywire Funds Insider Forums, where members share investment ideas and discuss everything to do with their money. Follow experienced investors, traders or friends and find the latest strategies to enhance your investment journey. Join our stock forum and become a better. Stock market discussion forum offers platform to discuss stock market in India. Share tips, knowledge, research or simply ask questions to fellow members of. Market Related Forums · Stock Market Nuts and Bolts · Beginner's Lounge · Derivatives · Commodities · Forex and Cryptocurrencies · International Markets. Corporate Actions: Buyback, Market Purchase or Sell · Special Situations. 21 ; Power grid - a superior alternative to Invits · Stock Opportunities. For all discussion centered around trading, strategies, and news. Alpaca Integration Applications. Use this category to discuss all things programming.

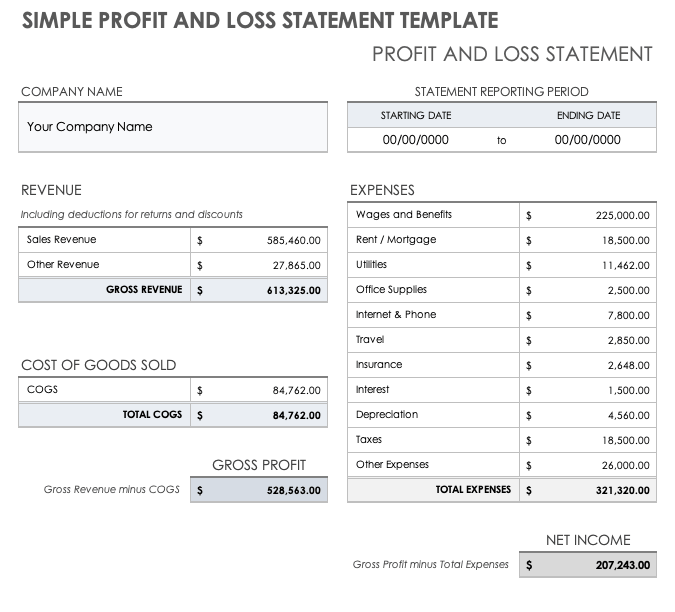

Profit N Loss Statement

How to Write a Profit and Loss Statement · Step 1 – Track Your Revenue · Step 2 – Determine the Cost of Sales · Step 3 – Figure Out Your Gross Profit · Step 4 –. Run the Income Statement to view your income, expenses and profit for the selected report period. Appendix 7 - Profit and Loss Statement. Profit And Loss Statement. CURRENT PERIOD, YEAR-TO-DATE. INCOME. Fee Income. $. $. Client Expense Income. In this guide, we'll walk through how a profit and loss statement works, what it can tell you, and how to create one easily. Income statement training that helps you understand what the numbers mean, ratios to know how the business is doing, and how much net profit the company. Profit and loss statements are also called P&L or income statements. They show all earnings and all costs over a time period, eg a quarter or a year. To get the. A P&L statement shows a company's revenues and expenses related to running the business, such as rent, cost of goods sold, freight, and payroll. Learn about profit and loss statements and how they help investors evaluate a company's financial condition and prospects for future growth. A profit and loss (P&L) statement is a financial report that summarizes a business's total income and expenses for a specific period. The profit and loss. How to Write a Profit and Loss Statement · Step 1 – Track Your Revenue · Step 2 – Determine the Cost of Sales · Step 3 – Figure Out Your Gross Profit · Step 4 –. Run the Income Statement to view your income, expenses and profit for the selected report period. Appendix 7 - Profit and Loss Statement. Profit And Loss Statement. CURRENT PERIOD, YEAR-TO-DATE. INCOME. Fee Income. $. $. Client Expense Income. In this guide, we'll walk through how a profit and loss statement works, what it can tell you, and how to create one easily. Income statement training that helps you understand what the numbers mean, ratios to know how the business is doing, and how much net profit the company. Profit and loss statements are also called P&L or income statements. They show all earnings and all costs over a time period, eg a quarter or a year. To get the. A P&L statement shows a company's revenues and expenses related to running the business, such as rent, cost of goods sold, freight, and payroll. Learn about profit and loss statements and how they help investors evaluate a company's financial condition and prospects for future growth. A profit and loss (P&L) statement is a financial report that summarizes a business's total income and expenses for a specific period. The profit and loss.

Generate your periodical profit and loss statements anywhere and instantly to your device. Copy this Profit and Loss Statement PDF template to your Jotform. Profit and loss is one of the three most important parts of the financial statement, the other two being the balance sheet and the cash flow statement. The P&L Statement shows revenues, expenses, gains, and losses over a specific period of time such as a month, quarter, or year. You can use this statement to track revenues and expenses so that you can determine the operating performance of your business over a period of time. A P&L statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given. What is a P&L Statement? A P&L statement is a document that compares the total income of a business against its debt and expenses. A P&L statement is an. Please complete a separate Profit and Loss Statement for each business owned by the borrower(s). Name(s) of Borrower(s). Company Name: Type of Business: For. Losses of business property (attach statement). Depletion of mines, oil and gas wells, timber, etc. (attach schedule). Other business expenses (explain in. How to Write a Profit and Loss Statement · Step 1 – Track Your Revenue · Step 2 – Determine the Cost of Sales · Step 3 – Figure Out Your Gross Profit · Step 4 –. How the Profit & Loss values are calculated The Profit and Loss, or Income Statement, is a financial statement typically presented alongside a Balance Sheet. Whether a business sells goods or provides services, a P&L statement can help determine how it has been performing in the past and predict how it may perform in. This guide will help you better understand your financial position by analyzing your profit and loss (P&L) statement. It indicates how the revenues (also known as the “top line”) are transformed into the net income or net profit (the result after all revenues and expenses have. A profit and loss statement is a financial statement that summarizes your company's revenue, costs and expenses incurred during a specified period. A profit and loss statement, also known as a P&L statement, measures a company's sales and expenses during a specified period of time. Please refer to the next page to see how Medi-Cal Access Program calculates your monthly income. MCAP Sample Profit & Loss Statement EN 01/30/ Page 2. HOW. Boost your financial analysis and decision-making with Tyms advanced profit and loss statement generator. Create comprehensive reports in just a few clicks and. What is a profit and loss statement (P&L)?. A profit and loss statement (P&L), also called an income statement or statement of operations, is a financial report. Here are some key terms for you to review as you explore Profit and Loss Statements. Profit and Loss Statement (P&L): also known as an Income Statement;. The profit and loss statement, or P&L, is a name sometimes used to describe a company's income statement, statement of income, statement of operations.

What Is A First Time Homebuyer Credit

The bill allows a refundable tax credit for first-time homebuyers of a principal residence in the United States who are at least 18 years of age and not claimed. First-time Homebuyer Credit Repayment · Date home was purchased (must be in ), · Original Credit from Form (or grayed out box Amount of credit. Information to help you look up a first time homebuyer credit account. LOAN: The 2nd Loan program offers a loan of up to 5% of the home's sale price with no maximum and is repayable at time of sale, refinance or first mortgage paid. The program provided qualified first-time Rhode Island homebuyers with a mortgage credit certificate. Homebuyers received a dollar-for-dollar tax credit of up. Is there a minimum credit score for first-time homebuyers? Credit score requirements vary from lender to lender. However, for most conventional mortgages. The first-time homebuyer tax credit was created to help stabilize a real estate market that went into freefall as a result of the subprime mortgage lending. The measure, often called the First-Time Homebuyer Act, amends the IRS tax law to provide up to $15, in refundable federal tax credits to first-time home. First-Time Home Buyers can also apply for a mortgage interest tax credit! If you are buying your first home, you can apply for a mortgage interest tax credit. The bill allows a refundable tax credit for first-time homebuyers of a principal residence in the United States who are at least 18 years of age and not claimed. First-time Homebuyer Credit Repayment · Date home was purchased (must be in ), · Original Credit from Form (or grayed out box Amount of credit. Information to help you look up a first time homebuyer credit account. LOAN: The 2nd Loan program offers a loan of up to 5% of the home's sale price with no maximum and is repayable at time of sale, refinance or first mortgage paid. The program provided qualified first-time Rhode Island homebuyers with a mortgage credit certificate. Homebuyers received a dollar-for-dollar tax credit of up. Is there a minimum credit score for first-time homebuyers? Credit score requirements vary from lender to lender. However, for most conventional mortgages. The first-time homebuyer tax credit was created to help stabilize a real estate market that went into freefall as a result of the subprime mortgage lending. The measure, often called the First-Time Homebuyer Act, amends the IRS tax law to provide up to $15, in refundable federal tax credits to first-time home. First-Time Home Buyers can also apply for a mortgage interest tax credit! If you are buying your first home, you can apply for a mortgage interest tax credit.

*The Minnesota Housing First-Generation Homebuyer Loan has funding to serve approximately 1, eligible borrowers on a first-come, first-served basis until. There shall be allowed as a credit against the tax imposed by this subtitle for such taxable year an amount equal to 10 percent of the purchase price of the. 2. How to use the tool. You can find the First-Time Homebuyer Credit Lookup tool at kobag.ru You will need your Social Security number, date of birth and. It's not currently possible to get the $15, first-time homebuyer tax credit. This is because the act has stalled in Congress and has yet to be passed into. The NC Home Advantage Tax Credit enables eligible first-time buyers (those who haven't owned a home as their principal residence in the past three years) and. If you have not held an ownership interest in your principal home within the past 3 years, you qualify as a first-time homebuyer. That means even if you have. Become a first-time homebuyer with fewer hassles and less money down. Take advantage of the unique Utah first-time homebuyer loan program from UFirst today! The first-time homebuyer tax credit was available to eligible homebuyers who closed on qualifying homes between April 8, , and Sept. 30, You'll need. Purpose of Form. Use Form to claim the first-time homebuyer credit. The credit may give you a refund even if you do not owe any tax. The primary tax credit available to first-time homebuyers is the mortgage credit certificate (MCC). This federal tax credit allows you to deduct a portion of. If you have previously owned a home for at least 5 consecutive years in the 8-year period which ends on the day you purchase your new home, and used it as your. Information for First-time Home Buyers - Effective August, , the state realty transfer tax rate was increased from % to % for property located in. The first-time homebuyer credit is similar to a year interest-free loan. Normally, it is repaid in 15 equal annual installments beginning with the second. You can access your account information using the IRS First-Time Homebuyer Credit Account Look-up tool. This will provide you with your total credit amount. The First-Time Homebuyer Tax Credit is a proposed federal tax credit for qualifying first-time homebuyers. It would provide a refundable tax credit of up to. If passed, this first-time home buyer tax credit would create a federal refundable tax credit for up to 10% of the purchase price of a primary residence up to. The credit varies by how much mortgage interest you pay and where you live. First-time homebuyers are also eligible for the same tax deductions typically. Offer subject to change and without notice. Offer may be combined with First-Time Homebuyer Discount for a maximum credit of $1,, or it may be combined with. I have a question about first time home buyer taxes. Is there a first time home buyer tax credit available? As a first time homebuyer, tax credit is not. The credit is 10 percent of the purchase price of the home, with a maximum available credit of $7, ($8, if you purchased your home in and ) for.

Free App That Pays You To Walk

Winwalk app is actually a free pedometer that counts your steps during every walk. And they reward you with points for every step. You get. For iPhone users, FitFetti is a free fitness app rewarding you with “fetti” (cash, credit, discounts, and free products) as you achieve weekly step goals. Winwalk combines health, fitness, and rewards in one intuitive app. Join our community, hit your step goals, and enjoy the rewards of a healthier lifestyle. Evidation is an app that can track your activity and reward you with points for things like walking, biking, running, swimming, etc. You can earn up to Make your every step count with Sweatcoin, the app that turns your miles into money, gift cards, & other cool rewards. Get paid to walk now! Strava is beloved by thousands of runners but it's also a great app for those who prefer walking. There's both a paid and free version. Best Apps That Pay You For Walking in India · 1. StepSetGo. StepSetGo is a popular Indian app that rewards users with coins for every step they take. · 2. Fitbit. Their tagline – “It pays to walk. Healthier planet. Healthier, wealthier you” sums it up. The rewards you can get are varied, including sports watches, music. CashWalk tracks your movement and awards you one Stepcoin for every steps you take. How you earn: Steps taken earn you in-app currency called Stepcoins. How. Winwalk app is actually a free pedometer that counts your steps during every walk. And they reward you with points for every step. You get. For iPhone users, FitFetti is a free fitness app rewarding you with “fetti” (cash, credit, discounts, and free products) as you achieve weekly step goals. Winwalk combines health, fitness, and rewards in one intuitive app. Join our community, hit your step goals, and enjoy the rewards of a healthier lifestyle. Evidation is an app that can track your activity and reward you with points for things like walking, biking, running, swimming, etc. You can earn up to Make your every step count with Sweatcoin, the app that turns your miles into money, gift cards, & other cool rewards. Get paid to walk now! Strava is beloved by thousands of runners but it's also a great app for those who prefer walking. There's both a paid and free version. Best Apps That Pay You For Walking in India · 1. StepSetGo. StepSetGo is a popular Indian app that rewards users with coins for every step they take. · 2. Fitbit. Their tagline – “It pays to walk. Healthier planet. Healthier, wealthier you” sums it up. The rewards you can get are varied, including sports watches, music. CashWalk tracks your movement and awards you one Stepcoin for every steps you take. How you earn: Steps taken earn you in-app currency called Stepcoins. How.

Apps like Sweatcoin, StepBet, and PK Rewards pay you to walk by tracking your steps. Walking for money motivates people to exercise more, improving physical. Sweatcoin: Walk for rewards such as health products or experiences Sweatcoin is another app that turns your steps into in-app currency called Sweatcoin which. Here's one more fitness-based “get money for walking” app if you don't want to bet or shop at Walgreens: LifeCoin. This app for Android and Apple devices tracks. WeWard offers you a unique way to discover new places, events, and more during your daily walks. Collect WeCards, complete chapters to earn rewards, and try to. winwalk is an app that acts like a pedometer. You download it, then track your walks and runs and earn rewards that can be cashed out as gift cards. If you're. Earlier this month, a free app called Sweatcoin launched in Australia. If you havent heard of it yet, the app counts a user's steps, and then depending on the. You earn money for charities. You choose the charity, you log the miles, and the charity gets the benefit. Lympo. Either walk or join challenges to earn the. The sweatcoin app tracks the number of steps using the iPhone's built-in sensors. It then rewards them with a digital currency called 'sweatcoins' for outdoor. Today, the free fitness app goes by the name Evidation, but functions in much the same way it always has. Evidations allows you to earn points which you can. Did you know that you can get paid to walk? It sounds too good to be true, but you can actually earn money while keeping your body healthy and active. Sweatcoin is probably one of the most well-known walk-and-earn apps out there. This app will reward you for sweating, and I mean that literally. To do so, you. MapMyWalk GPS for iPhone, Android or Windows MapMyWalk allows you to see the time spent walking, distance, pace, speed, elevation, and calories burned. When. WinWalk is a free pedometer app for Android that lets you earn free gift cards for exercising. You don't have to create an account or provide an email address. Like most apps nowadays, Evidation is free to use. Something that is also unusual about the app is that although it is mainly a fitness app, you can also earn. Gigwalk is a free app that can connect you to local gigs in your area. Gigwalkers can earn from $3 to $ or more for each Gig, depending on how much time is. This list started out a long time ago with just five apps, and now there are a TON of different apps coming out that promise cash for steps. If you want to get paid to walk outside, SweatCoin is the right app for you! They do not count in treadmills and walking around inside the house, however, if. Download the APK of Sweatcoin Pays You To Get Fit for Android for free. Get rewards for walking and doing sports. Sweatcoin Pays You To Get Fit is an app. WinWalk is a highly rated pedometer app on the Google Play Store, with stars and 1 million+ downloads. It's free, tracks steps, and rewards users with gift. With this free app, you can get coins simply by walking. You can redeem them for gift cards from your favorite brands! Your steps, your wealth - with.

American Funds New Perspective Ret Acct

Holdings for New Perspective Fund are updated quarterly and provide: security name, asset type, amount, market value and percentage of net assets. American Funds New Perspective Fund® · 1. Safran SA. Nuclear weapons. $B. % · 2. Airbus SE. Nuclear weapons. $M. % · 3. TransDigm Group Inc. The fund seeks to take advantage of investment opportunities generated by changes in international trade patterns and economic and political relationships. The New Perspective Fund, Class A Shares (ANWPX) is a mutual fund that aims to provide investors with a diversified portfolio of global equities. ANWPX - American Funds New Perspective A - Review the ANWPX stock price, growth, performance, sustainability and more to help you make the best investments. ANWPX - New Perspective Fund - American Funds New Perspective Fund Class A Stock - Stock Price, Institutional Ownership, Shareholders (MUTF). Invests primarily in common stocks that are believed to have the potential for growth. The fund may invest up to % of assets outside the United States. Previous close. The last closing price. $ ; YTD return. Year to date return as of Jun 30, % ; Expense ratio. Percentage of fund assets used for. New Perspective Fund (Class F-2 | Fund | ANWFX) seeks to provide long-term growth of capital. Holdings for New Perspective Fund are updated quarterly and provide: security name, asset type, amount, market value and percentage of net assets. American Funds New Perspective Fund® · 1. Safran SA. Nuclear weapons. $B. % · 2. Airbus SE. Nuclear weapons. $M. % · 3. TransDigm Group Inc. The fund seeks to take advantage of investment opportunities generated by changes in international trade patterns and economic and political relationships. The New Perspective Fund, Class A Shares (ANWPX) is a mutual fund that aims to provide investors with a diversified portfolio of global equities. ANWPX - American Funds New Perspective A - Review the ANWPX stock price, growth, performance, sustainability and more to help you make the best investments. ANWPX - New Perspective Fund - American Funds New Perspective Fund Class A Stock - Stock Price, Institutional Ownership, Shareholders (MUTF). Invests primarily in common stocks that are believed to have the potential for growth. The fund may invest up to % of assets outside the United States. Previous close. The last closing price. $ ; YTD return. Year to date return as of Jun 30, % ; Expense ratio. Percentage of fund assets used for. New Perspective Fund (Class F-2 | Fund | ANWFX) seeks to provide long-term growth of capital.

Fact Sheet | American Funds New Perspective Fund. MissionSquare Retirement N. Capitol Street, NE, Washington, DC kobag.ru FS News and analysis for professional fund investors across the USA. The Fund seeks to take advantage of investment opportunities generated by changes in international trade patterns and economic and political relationships by. Get American Funds New Perspective Fund (FFPNX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. The fund's investment objective is to provide you with long-term growth of capital. Manager The fund is managed by Capital Research and Management Company. The Fund seeks long-term growth of capital with future income as a secondary objective. The Fund seeks to take advantage of investment opportunities generated. Get the latest American Funds New Perspective Fund® Class C (NPFCX) real-time quote, historical performance, charts, and other financial information to help. Objective. The investment seeks long-term growth of capital. The fund seeks to take advantage of investment opportunities generated by changes in international. This fund. ANWPX - American Funds New Perspective Fund®. 19% ; Benchmark. ACWI - iShares MSCI ACWI ETF. 19% ; Fund compared to benchmark. %. The fund seeks to take advantage of investment opportunities generated by changes in international trade patterns and economic and political relationships. The fund is a core large-cap holding in a portfolio for investors who are comfortable with and understand the risks of an all-world portfolio. ANWPX Performance - Review the performance history of the American Funds New Perspective A fund to see it's current status, yearly returns, and dividend. See performance data and interactive charts for American Funds New Perspective Fund (ANWPX). Research information including trailing returns and. The investment seeks long-term growth of capital. The fund seeks to take advantage of investment opportunities generated by changes in international trade. View the latest American Funds New Perspective Fund;A (ANWPX) stock price, news, historical charts, analyst ratings and financial information from WSJ. The fund's investment objective is to provide you with long-term growth of capital. Seeks to take advantage of evolving global trade patterns by predominantly. This page shows ETF alternatives to the ANWPX mutual fund. The ETFs in the tables consist of ones that track the same index and are in the same ETFdb. American Funds New Perspective Fund® A (ANWPX) key stats comparison: compare with other stocks by metrics: valuation, growth, profitability, momentum. The Fund seeks long-term growth of capital with future income as a secondary objective. The Fund seeks to take advantage of investment opportunities. New Perspective Fund (Class A | Fund | CNPAX) seeks to provide long-term growth of capital.

Investing In Your 40s

Below are our 4 Top Tips for people in their 40s who are looking at investing for a secure financial future. Investments can be a great way to grow wealth for these goals over time. But there are also alternative options to help you grow your wealth and provide a. How to save and build wealth in your 40s · 1. Emergency fund · 2. A debt-free plan · 3. Save for retirement at 40 · 4. Investing in your 40s outside of non-. How to Invest Wisely in Your 40s · 1. Consider investing in stocks. A stock is a share of ownership in a company, and over time it can be an excellent way to. If you begin investing in your 40s, there's still plenty of time before retirement. This may allow you to take a bit more risk for higher potential returns. As. Some may tell you that if you are already over 40, your chances of getting a good enough return on your investment to live off of is slim, but you have been. If your investments allow you to live comfortably, allow you to I say this sincerely, don't spend money in your 40s and 50s like I did. Are you in your 40s or 50s and planning for an early retirement? Here are some of the investments you can make to boost your retirement savings. There are a lot of factors that contribute to how much money you can save for your retirement if you start in your 40s. You'll have to look at your expenses and. Below are our 4 Top Tips for people in their 40s who are looking at investing for a secure financial future. Investments can be a great way to grow wealth for these goals over time. But there are also alternative options to help you grow your wealth and provide a. How to save and build wealth in your 40s · 1. Emergency fund · 2. A debt-free plan · 3. Save for retirement at 40 · 4. Investing in your 40s outside of non-. How to Invest Wisely in Your 40s · 1. Consider investing in stocks. A stock is a share of ownership in a company, and over time it can be an excellent way to. If you begin investing in your 40s, there's still plenty of time before retirement. This may allow you to take a bit more risk for higher potential returns. As. Some may tell you that if you are already over 40, your chances of getting a good enough return on your investment to live off of is slim, but you have been. If your investments allow you to live comfortably, allow you to I say this sincerely, don't spend money in your 40s and 50s like I did. Are you in your 40s or 50s and planning for an early retirement? Here are some of the investments you can make to boost your retirement savings. There are a lot of factors that contribute to how much money you can save for your retirement if you start in your 40s. You'll have to look at your expenses and.

HDFC Bank offers various retirement plans and a simple and convenient way of investing in these products. You can manage your investments online. Tips to save more in your 40s · Always consider your debts. When you're working out a saving plan, it's important to remember that compound interest is a two-. If you're behind on saving in your 40s and 50s, aim to pay down your debt to free up funds each month. Also, be sure to take advantage of retirement plans and. Evaluate income and expenses · Prepare for the unexpected · Max out your retirement contributions · Develop a smart investment strategy. Investing in Your 40s: 4 Finance Strategies to Put in Place · 1. Get Strategic with Education Savings · 2. Optimize Your Taxes · 3. Tackle Your Debt · 4. Hire. How to save and build wealth in your 40s · 1. Emergency fund · 2. A debt-free plan · 3. Save for retirement at 40 · 4. Investing in your 40s outside of non-. If you're able to use extra income to invest in stocks, take a look at your savings goals and their related timelines. These years are a prime time to grow your. There's an old rule of thumb that for every decade you age before you start saving, the percentage of your income you should put toward retirement increases by. Regardless of your age, it's never too early or too late to start investing. But, it's important to revisit your risk profile at every stage of life to make. While we're not suggesting that you don't enjoy earning more, you don't have to spend all of those extra earnings. Every dollar you save or invest in your 40s. As you get closer to retirement – or at least wanting to rely more on your investments for an income – your portfolio balance should shift to investments that. Instead of investing in financial products with higher returns (riskier), you are more inclined to choose lower-risk financial products. Try to use your ISA allowance. If you're investing in your 40s, you'll likely want to try and maximise your potential profits as you'll have less time for your. Yet, my early 40s too and just started investing. Upvote 1. Downvote Aggressively invest in your 20s and slow down in 30s? Learn how to invest wisely in your 40s. Explore factors to consider, set financial goals, and start your investment journey effectively. Exactly how much you should invest in stocks versus bonds can be a tricky question. One common guideline is to subtract your age from ; that figure is the. We often see individual investors fixate on one number: returns. This can be a dangerous mindset. At the onset of your career, and throughout your high earning. Some may tell you that if you are already over 40, your chances of getting a good enough return on your investment to live off of is slim, but you have been. It's never too late to start investing and, in your 40s, you're still young enough to see significant growth through compounding returns. In your 40s, you're often reaching your peak earning years, so obviously there's going to be some temptation to, you know, let your lifestyle creep up a little.

Life Insurance Investment Pros And Cons

I've read several articles talking about using a whole life insurance policy as an investment vehicle for retirement. For higher-income earners already maxing out their retirement accounts, life insurance is one of the few remaining tax-advantaged account option with the. There are disadvantages to drawing on your policy: It reduces the amount of the death benefit and, if there isn't enough cash value to fund the policy, the. Expensive: Whole life insurance is more expensive than term, as it provides lifetime coverage and builds up a cash value. 2. Limited Investment. As the investments grow, so does the cash value of your policy. This means that in addition to providing a death benefit to your beneficiaries upon your passing. Pros and cons of cash value life insurance Cash value life insurance can be valuable to some, but it's not the right tool for all. If you don't need lifetime. Whole life insurance provides a death benefit to your heirs, as well as a cash value component that you can access for other expenses. Pros and Cons of Whole Life Insurance · Smaller death benefit – Whole life is more expensive than term insurance, so you can only buy a smaller death benefit. Advantages and disadvantages of life insurance include financial protection, peace of mind, and more costly premiums with permanent policies. I've read several articles talking about using a whole life insurance policy as an investment vehicle for retirement. For higher-income earners already maxing out their retirement accounts, life insurance is one of the few remaining tax-advantaged account option with the. There are disadvantages to drawing on your policy: It reduces the amount of the death benefit and, if there isn't enough cash value to fund the policy, the. Expensive: Whole life insurance is more expensive than term, as it provides lifetime coverage and builds up a cash value. 2. Limited Investment. As the investments grow, so does the cash value of your policy. This means that in addition to providing a death benefit to your beneficiaries upon your passing. Pros and cons of cash value life insurance Cash value life insurance can be valuable to some, but it's not the right tool for all. If you don't need lifetime. Whole life insurance provides a death benefit to your heirs, as well as a cash value component that you can access for other expenses. Pros and Cons of Whole Life Insurance · Smaller death benefit – Whole life is more expensive than term insurance, so you can only buy a smaller death benefit. Advantages and disadvantages of life insurance include financial protection, peace of mind, and more costly premiums with permanent policies.

As such, whole life is not an investment. Instead, it's an asset that protects all other assets. And because it's not correlated to the market, whole life. While term life insurance only provides a death benefit (which is unlikely to ever pay off), whole life insurance can be an additional investment vehicle for. 1. Affordability: Term life insurance offers relatively low premiums compared to permanent life insurance. This affordability makes it an. Long-term Financial Commitment: Most policies require large monthly or annual contributions. Unlike other investment options, you cannot simply stop. Whole life insurance builds cash value, provides permanent coverage, and can help build your family's wealth over the long term. ROP policies typically come with higher premiums than standard term life insurance due to the return-of-premium feature. By investing smartly, you could. Risks of Using Life Insurance as an Investment · No guarantee. Life insurance investments still carry a certain level of risk, similar to any other investment. Some customers prefer permanent life insurance because the policies typically contain an investment or savings vehicle. A portion of each premium payment is. Most policyholders pay higher than their monthly rates to cover the policy and associated fees. Otherwise, payments and fees subtract from investment gains. The. Whole life guarantees steady cash value growth that can complement other fixed-income investments such as k in your portfolio. However, life insurance is. Pros and Cons of a Life Insurance Investment · The cash value can act as a stream of income during retirement. · Your cash value grows tax-deferred. · Accessing. Nearly unlimited saving*, Potentially fewer investment options ; Tax-deferred build-up of cash value, Savings potential limited by cost of death benefit ; Tax-. The disadvantage is that you have to pay monthly or annual premiums for this benefit. The pros of having life insurance outweigh the cons for. The pros and cons of term and whole life insurance are clear: Term life insurance is simpler and more affordable but has an expiration date and doesn't. If you are not good at saving or investing money, then a whole life policy might be an ideal solution for you. Any money you invest in the stock market or other. If you are not good at saving or investing money, then a whole life policy might be an ideal solution for you. Any money you invest in the stock market or other. But remember, any non-guaranteed policy comes with a market risk that your investment could flop. Despite these risks, some agents will try to sell you the. Each type of life insurance has its own pros and cons. Consider factors such as your risk tolerance, available capital to spend, cost of the policy and the. Before investing in a VUL policy, it's important to assess if this is the best type of life insurance for you. Because VUL involves market investments, there is. However, the returns offered by these plans are much lesser than standalone investment instruments. Issues with claim settlement. Life insurance policies have.

Livepeer Crypto

Grayscale Livepeer Trust is one of the first securities solely invested in and deriving value from the price of Livepeer Token ("LPT") that enables. About Livepeer. Livepeer is a decentralised video streaming network built on the Ethereum blockchain. Using Livepeer, anyone can integrate video content into. LPT is an Ethereum token that powers the Livepeer network, a platform for decentralized video streaming. LPT is required to perform the work of transcoding. Livepeer (LPT) is built on the Ethereum blockchain, and it uses a modified version of delegated proof of stake (DPoS) consensus mechanism. In this DPoS. Livepeer is a decentralized video streaming network built on the Ethereum blockchain. crypto-economic incentives for participants to deliver an. Livepeer initially launched on Ethereum but has since been redeployed to Arbitrum. We believe crypto is the technology of free people, free thinking, and free. In Livepeer, new tokens are minted every so-called round. Rounds are measured in Ethereum blocks, where one round is equal to Ethereum blocks. In Ethereum. LPT is an ERC token and serves as the native asset of the Livepeer Network which is an application built on the Ethereum Network that is used to coordinate. Livepeer is a network built on Ethereum for transcoding live and on-demand video. Livepeer differentiates itself from traditional video streaming services. Grayscale Livepeer Trust is one of the first securities solely invested in and deriving value from the price of Livepeer Token ("LPT") that enables. About Livepeer. Livepeer is a decentralised video streaming network built on the Ethereum blockchain. Using Livepeer, anyone can integrate video content into. LPT is an Ethereum token that powers the Livepeer network, a platform for decentralized video streaming. LPT is required to perform the work of transcoding. Livepeer (LPT) is built on the Ethereum blockchain, and it uses a modified version of delegated proof of stake (DPoS) consensus mechanism. In this DPoS. Livepeer is a decentralized video streaming network built on the Ethereum blockchain. crypto-economic incentives for participants to deliver an. Livepeer initially launched on Ethereum but has since been redeployed to Arbitrum. We believe crypto is the technology of free people, free thinking, and free. In Livepeer, new tokens are minted every so-called round. Rounds are measured in Ethereum blocks, where one round is equal to Ethereum blocks. In Ethereum. LPT is an ERC token and serves as the native asset of the Livepeer Network which is an application built on the Ethereum Network that is used to coordinate. Livepeer is a network built on Ethereum for transcoding live and on-demand video. Livepeer differentiates itself from traditional video streaming services.

The average trading price is expected around $ Potential ROI: %. August Livepeer Price Forecast. Crypto analysts expect that at the end. If you're looking to bridge your Livepeer (LPT) tokens from Ethereum to Arbitrum, check out our latest blog post for a straightforward guide. We cover. Buy Livepeer Crypto Hat (Embroidered Vintage Cotton Twill Cap) Live Peer Black: Shop top fashion brands Hats & Caps at kobag.ru ✓ FREE DELIVERY and. Livepeer runs on the Ethereum blockchain and, as such, its native cryptocurrency, LPT, is an ERC20 token. It has a maximum supply of 26,, What are. The price of Livepeer (LPT) is $ today with a hour trading volume of $93,, This represents a % price increase in the. Livepeer is a decentralized video streaming network built on the Ethereum blockchain and aims to decentralize live video broadcasts over the internet. The Livepeer project aims to deliver a live video-streaming network protocol that is fully decentralized, highly scalable and crypto-token incentivized to. Livepeer is a decentralized video streaming network protocol built on the Ethereum blockchain. It aims to deliver a more cost-effective way to stream by. The Livepeer (LPT) project is a network built on Ethereum and focused on building infrastructure to enable developers to make video streaming applications. crypto. With Guarda, you can easily create online Livepeer wallet app for PC Livepeer is a fully decentralized service, based on Ethereum blockchain. Livepeer USD price, real-time (live) charts, news and videos. Learn about LPT value, livepeer cryptocurrency, crypto trading, and more. AI program to contribute to the future of decentralized video creation. Introducing The Livepeer AI Subnet. The Livepeer project aims to deliver a live video streaming network protocol that is fully decentralized, highly scalable, crypto token incentivized. Livepeer Cryptocurrency Coffee Mug makes for elegant gifts that speaks of a person's uniqueness. Don't sweat over the right gifts! Web3 video. Now @Livepeer Our Twitter handle is now @Livepeer! Spread the word with a retweet! Image. What is Livepeer? Livepeer is a blockchain platform that focuses on creating a decentralized and democratic platform for live video broadcasting. Livepeer USD Price Today - discover how much 1 LPT is worth in USD with converter, price chart, market cap, trade volume, historical data and more. Livepeer (LPT) reached the lowest price of USD on Jun 9, View more Livepeer dynamics on the price chart. See the list of crypto losers to find. Livepeer price live updates on The Economic Times. Check out why Livepeer price is falling (25 Aug ) today. Get detailed Livepeer cryptocurrency price. Etherscan is a Block Explorer and Analytics Platform for Ethereum, a decentralized smart contracts platform. Background Map Image. Company. About Us · Brand.

Best Way To Transfer Large Sum Of Money Between Banks

You can transfer as much money as you want without a problem, so long as it is done between accounts within the banking system. Transferring money between HSBC and other financial institutions is easy. Large sums should be transferred internationally via a wire kobag.ru fees for wire transfers are generally fixed fees so the amount. With the right third-party payment service, you can easily send large sums of money without worrying about transaction limits. However, it is important to. Transfer money between your personal M&T and verified non-M&T accounts. · Manage your non-M&T account(s) · Schedule your bank to bank transfer · View transfer. Although you'll pay a wire transfer fee, you can generally send a larger amount of money compared to low-cost or no-cost alternatives such as an automated. For sending a large amount of money, wire transfers can be a solution. To make a wire transfer, you'll need the recipient's name and address and their bank. The best way you can transfer money from one bank to another via an electronic transfer. Both accounts could be yours, or one could belong to someone you're. Cash is another option for transferring money, as it is free to withdraw money from one bank and make a deposit at the bank where the recipient has a checking. You can transfer as much money as you want without a problem, so long as it is done between accounts within the banking system. Transferring money between HSBC and other financial institutions is easy. Large sums should be transferred internationally via a wire kobag.ru fees for wire transfers are generally fixed fees so the amount. With the right third-party payment service, you can easily send large sums of money without worrying about transaction limits. However, it is important to. Transfer money between your personal M&T and verified non-M&T accounts. · Manage your non-M&T account(s) · Schedule your bank to bank transfer · View transfer. Although you'll pay a wire transfer fee, you can generally send a larger amount of money compared to low-cost or no-cost alternatives such as an automated. For sending a large amount of money, wire transfers can be a solution. To make a wire transfer, you'll need the recipient's name and address and their bank. The best way you can transfer money from one bank to another via an electronic transfer. Both accounts could be yours, or one could belong to someone you're. Cash is another option for transferring money, as it is free to withdraw money from one bank and make a deposit at the bank where the recipient has a checking.

Ask a teller to transfer. The easiest way to transfer might be to stop into the bank and ask a teller to move some money around. Have your account. If your online account offers check-writing, write yourself a check to deposit into your account of choice – it will clear faster than an online money transfer. This financial institution allows money to travel between banks internationally. It assigns every bank a unique identifier code to ensure the transfer always. There is also a substantial disconnection between the bank back Learn how Currency Exchange Banks are the ideal path to send large sums to Brazil. Bank-to-bank transfers within the United States traditionally operate using the ACH system. One of the fastest ways to transfer money between bank accounts is. Make large money transfers for a low, fixed fee · A Zenus account saves you money every time you move large sums. · Transferring significant sums of money can be. Although you'll pay a wire transfer fee, you can generally send a larger amount of money compared to low-cost or no-cost alternatives such as an automated. Go to your bank branch in person. You can send larger amounts in one go if you go to your bank in person, rather than doing it online or over the phone. With the right third-party payment service, you can easily send large sums of money without worrying about transaction limits. However, it is important to. By law, banks report all cash transactions that exceed $10, — the international money transfer reporting limit set by the IRS. In addition, a bank may report. You'll need to provide your bank with the routing number of the bank you're transferring money to, as well as your account number to link the two accounts and. 2. Wire Transfers You can send large sums of money from one bank account to another with a wire transfer. These types of transfers are initiated through a. The best way you can transfer money from one bank to another via an electronic transfer. Both accounts could be yours, or one could belong to someone you're. USAA allows you to easily send money to others or move money between your own bank accounts. Learn how USAA makes this an easy task for all their members. It's easy to transfer money. Move money between your U.S. Bank accounts – and to and from accounts at other banks. With U.S. Bank mobile and online banking. To transfer money between accounts at Wells Fargo and accounts at another bank, select Add Non-Wells Fargo Accounts. Frequently asked questions. How do I. It's a safe and secure way to move money without having to handle cash. How do bank transfers work? Making a bank transfer is a normal part of managing your. However, transferring money from one bank account to another may be taxable if it's large amounts or received as part of a business-like activity or in relation. Bank-to-bank money transfer. A wire transfer is a safe way to transfer money from one bank to another. Traditional bank wire transfers are often used for. How to transfer money to another bank account Best for urgent, large payments – same-day payment, normally for large sums of money like a house deposit.